According to the Special Defence Contribution (SDC) legislation all companies should distribute 70% of their after-tax profits within two years from the tax year in which the profits are generated (e.g. for the year 2017 the distribution should be done on 31/12/2019).

When dividends are distributed, SDC is deducted at source at 17% and the net amount is paid to the shareholders. The SDC has to be paid to the Tax Department at the end of the following month after the actual distribution date.

If the company will not distribute the 70% of the profits up to the due date, the SDC has to be paid and this is called the deemed dividend distribution.

When an actual dividend is paid after the deemed dividend distribution, the SDC is paid only on the amount of the actual dividend which is over the amount of dividend which was deemed distributed.

Any actual dividends paid during the two following years in respect of the relevant year of profits will be deducted before the calculation of deemed dividend distribution.

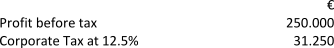

Example 1:

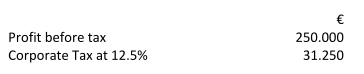

ABC Ltd has the below profits before tax for the year 2017:

Assumptions:

- No actual dividends issued during the years 2017, 2018 and 2019 from the profits of 2017.

- All Shareholders are Cypriots resident individuals.

Tax treatment:

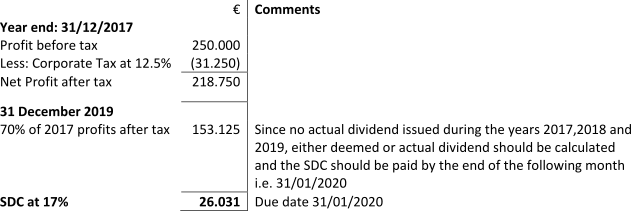

Example 2:

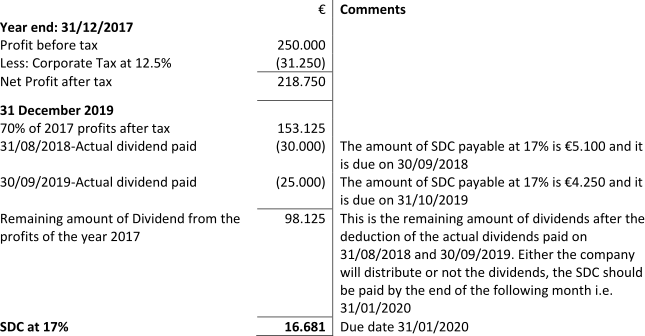

ABC Ltd has the below profits before tax for the year 2017:

Assumptions:

- Actual dividends paid from the profits of 2017 as below:

- €30.000 on 31/08/2018

- €25.000 on 30/09/2019

- All Shareholders are Cypriots resident individuals.

Tax treatment:

Exemptions from SDC:

- Dividends paid to non-residents individuals and companies

- Dividends paid to non-domiciled individuals (see below the explanation)

- Dividends paid to other Cyprus company (four years rule apply and you can see below the explanation)

What does a non-domiciled person mean?

Foreigners who decide to move their personal tax residency in Cyprus will automatically be considered as non-domiciled in Cyprus for a maximum of 17 years.

In accordance with the provisions of the Wills and Succession Law, there are two kinds of domicile:

- domicile of origin, i.e. the domicile received at birth (generally dependent on the father side), or

- domicile of choice, i.e. domicile acquired by establishing a physical presence in a particular place

Regardless of the domicile of origin or choice, individuals who have been tax resident in Cyprus for at least 17 out of the last 20 years prior to the tax year in question, will be deemed to be domiciled in Cyprus for the purposes of the SDC Legislation.

In the case of persons who have their domicile of origin in Cyprus, they will be considered as non-domicile in the following cases:

- An individual with a domicile of origin in Cyprus, who has acquired and maintains a domicile of choice outside of Cyprus and was not a tax resident in Cyprus for at least 20 consecutive years prior to the tax year.

- An individual who was not a tax resident in Cyprus for at least 20 consecutive years immediately before the 16 July 2015.

As per above, any individual who is either non-domiciled or non-resident in Cyprus is not liable to SDC on Dividends.

Example 3:

Mr Luis (with a domicile of origin in Spain) has moved to Cyprus in the year 2016 and he became tax resident (non-domiciled) He is a shareholder in Cyprus company ABC Ltd.

Assumptions

In the year 2018 the Company BE Ltd declared an actual dividend of €100.000 to Mr Luis

Tax Treatment

No SDC should be paid on the dividends since Mr Luis is a non-domiciled person.

What does four-years rule mean?

As mentioned above if actual dividends will be distributed, the company-to-company exemption will apply and no SDC will be paid.

Since 2012 when a dividend that is indirectly paid after four years from the end of the year in which the profits were generated, out of which the said dividends was distributed, is subject to SDC.

The four years rule does NOT apply if the ultimate shareholder of the Cyprus company is non-resident or non-domiciled person.

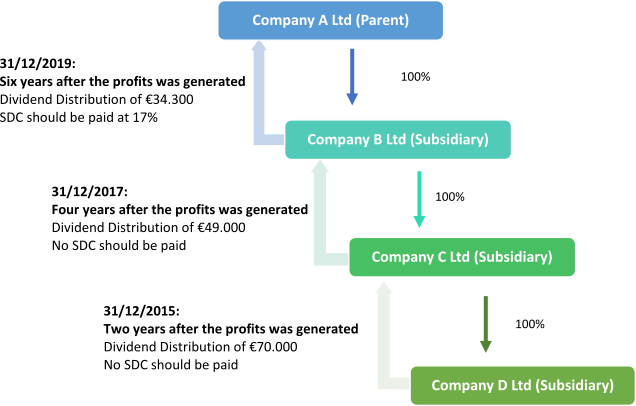

Example 4:

Company A Ltd holds the 100% of Company B Ltd, Company B Ltd holds the 100% of Company C Ltd which holds the 100% of Company D Ltd. The companies A Ltd, B Ltd and C Ltd are investment companies and have no other activities other than the holding of shares. All companies are Cyprus tax resident and the shareholder of company A Ltd is Cyprus tax resident individual.

Assumptions:

31 December 2013

Company D Ltd makes profit after tax €100.000

31 December 2015(2 years passed from the year that the profits were generated)

The Company D Ltd declared an actual dividend to its shareholder Company C Ltd.

The dividend is the 70% of the profits after tax from the year 2013.

31 December 2017(4 years passed from the year that the profits were generated)

The Company C Ltd declared an actual dividend to its shareholder Company B Ltd.

The dividend is the 70% of the profits after tax from the year 2015

31 December 2019(6 years passed from the year that the profits were generated)

The Company B Ltd declared an actual dividend to its shareholder Company A Ltd.

The dividend is the 70% of the profits after tax from the year 2017

Tax Treatment:

Company D Ltd

Two years (i.e. 31/12/2015) after the end of the year that the profits were generated, Company D Ltd declares dividend of €70.000 (€100.000*70%). The dividend is not subject to SDC since this is an actual dividend between two Cyprus tax-resident companies, within 2 years from the date that the profits arise.

Company C Ltd

Two years (i.e. 31/12/2017) later, the Company C Ltd declares actual dividend of €49.000 (which is the 70% of the €70.000 that company C Ltd received two years ago from Company D Ltd). The dividend is not subject to SDC since this is an actual dividend between two Cyprus tax-resident companies, within 4 years from the date that the profits arise.

Company B Ltd (6 years passed from the end of the year in which the profits were generated)

Two years (i.e. 31/12/2019) later, the company B Ltd declares actual dividend of €34.300(which is the 70% of the €49.000 that company B Ltd received two years ago from Company C Ltd).

In this case the four years rule applies since more than 4 years passed from the end of the year in which the profits were generated (i.e. 31/12/2013). SDC is payable at 17% (€34.300*17%) which is €5.831. The net dividend that Company A Ltd will receive is €28.469.

Company A Ltd

When company A Ltd will pay dividend to its Cyprus tax residents’ shareholders, no SDC will be deducted again.